Paying off your mortgage

This page provides information and guidance if you’re considering paying off your mortgage before the end of the term. This is also known as redeeming your mortgage.

You can redeem your mortgage in full at any time. This could be because you’re remortgaging with another lender, selling your property or you simply want to pay off your mortgage before the end of its term. You won’t have to pay an early repayment charge if you redeem your mortgage for any reason.

Our new redemptions virtual assistant

We’ve now launched a new redemptions virtual assistant, to help answer your questions about the redemptions process.

To use the redemptions virtual assistant, simply click on the small button that’s hovering in the bottom right corner of this page.

You can then start a conversation by asking the redemptions virtual assistant a question, or by selecting one of the handy in-built options.

Please note – the virtual assistant tool will only display and work correctly if you’ve enabled Statistics cookies on this website. You can check or change your preferences on our cookies page.

Customers reaching the end of their mortgage term

If you have an interest only or part & part mortgage and you won’t have the funds to repay your balance in full by the term end date, please contact us to discuss your options. Read more about Interest Only mortgages.

If you have a repayment mortgage and your payments are up to date, your mortgage will redeem naturally after you make your final payment. If you pay by Direct Debit we’ll stop collecting payments automatically.

See your current balance

If you just want to get an idea of what you currently owe rather than an exact redemption amount, you don’t need to request a redemption statement. Instead you can check your current balance via Self-Serve, our secure online mortgage service, which is available 24 hours a day, 7 days a week. See our website section about your account information for more information.

How to redeem your mortgage

When you’re ready to redeem your mortgage, the first thing you’ll need to do is request a redemption statement. This shows how much you owe on your mortgage, including any fees payable, on a given date when you plan to pay off your mortgage.

If you have a solicitor or conveyancer acting on your behalf, ask them to request the redemption statement for you through Lender Exchange, which is a secure portal that’s quick and easy for legal firms to use.

Most solicitors and conveyancers will be very familiar with mortgage redemptions and will handle this process for you. However, if you don’t have a solicitor acting for you, or just want more information, please see the drop-down sections below.

You can request a redemption statement using Self-Serve, in writing or over the phone. We’ll typically produce and post your statement within 8-10 working days from when we receive your request, although it could take longer.

The length of time it takes us to produce and send your Redemption Statement is the same regardless of how you make the request.

Request a statement using Self-Serve

You can quickly request a redemption statement using Self-Serve, our secure online system, which is available 24 hours a day, 7 days a week.

You can see our handy guide on how to do this at the bottom of this page.

Request a statement in writing or by phone

If you write to us, to help avoid delays, please include the following within the letter:

- Account number

- Name and address of account holder(s)

- Planned date of redemption

To call or write, please find our contact details here.

Your redemption statement shows you exactly how much you owe on your mortgage, including any fees payable. The amount is based on the planned date of redemption that you provided when you requested the statement.

If your redemption statement includes a daily interest amount, you can use that figure to adjust the total amount required if you’re going to make your redemption payment slightly before or after the stated redemption date. You don’t necessarily need to request another redemption statement.

However, if the redemption payment is to be made after the end of the month in which the statement was issued, you’ll need to request a new redemption statement to make sure you have an accurate total redemption figure.

A redemption payment can only be made by online bank transfer or cheque. It cannot be made over the telephone. Please see the details below.

Online bank transfer

Please transfer the required amount, using the correct bank details – including your mortgage account number as the reference.

For Hessonite Mortgages, we have different bank account details depending on your type of account.

If your account number begins with 4, 5 or 6:

Account name: Topaz Finance Limited

Sort code: 40-41-70

Account number: 00038792

Reference: Your mortgage account number

If your account number begins with 1:

Account name: Topaz Finance Limited

Sort code: 40-41-70

Account number: 20038806

Reference: Your mortgage account number

If you are unsure of which bank details to use, please call us.

Cheque payment

Cheques for the required amount should be made payable to Hessonite Mortgages and your mortgage account number should be written on the reverse.

Please post your cheque to:

Hessonite Mortgages

PO Box 140

Gateway House

Skipton

BD23 9GF

Next steps

We’ll apply the payment and confirm the mortgage is redeemed within 15 working days after receipt of the funds. We’ll send a confirmation letter to you and any other account holders named on the mortgage.

If you make your monthly payments by Direct Debit, we recommend you don’t cancel your Direct Debit until your mortgage has redeemed.

If you will be moving home quickly after making the redemption payment, please contact us and provide a forwarding address so we know where to send our confirmation letter.

Source of funds

If the redemption payment you are making is for £10,000 or more, we may ask you to provide us with evidence which shows the source of the funds. This is a normal part of UK money laundering regulation, and we may contact you about this if required.

Where redemption monies are received via a solicitor or conveyancer, we don’t require source of funds evidence.

You won’t have to pay an early repayment charge to us if you redeem your mortgage for any reason.

You may need to pay a Mortgage Exit Administration fee, which will be added to the final amount that you owe us. The fee varies for different customers and will be included on your Redemption Statement when this applies. You can also find details of this on your original mortgage offer, where it may have previously been referred to as a Mortgage Discharge Fee.

Where the amount of redemption funds received is more than the amount required to redeem the loan, we’ll aim to refund you within 15 working days of receiving the funds.

We’ll return any surplus funds to your bank account where we’re able to do so.

Where this isn’t possible, we’ll post a cheque to you, issued in the names of all parties to the account. If a cheque is requested in any other name e.g., sole name but it is a joint account, written authorisation signed by all parties to the account will be required.

If the amount received on redemption isn’t enough to pay off the loan in full, we’ll apply the funds we’ve received as a capital repayment to reduce the balance owed.

We’ll write out after receipt of the funds to confirm the remaining balance still required.

Request a redemption statement using Self-Serve

You can quickly request a redemption statement using Self-Serve, our secure online system, which is available 24 hours a day, 7 days a week.

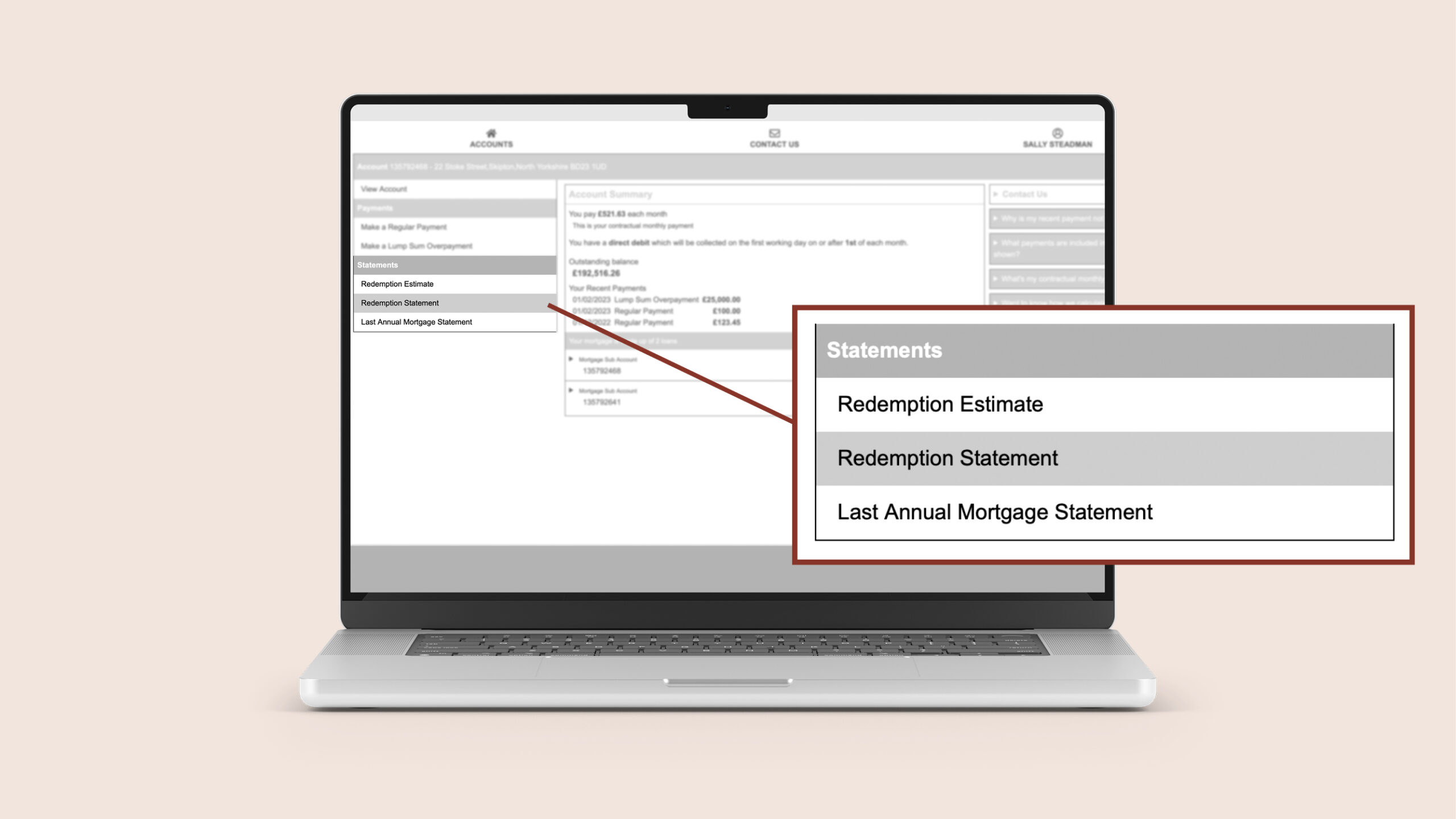

Step 1

Sign-in to Self-Serve and click on the Redemption Statement tab in the Statements menu showing on the left hand side of the Account Summary screen.

Sign In/Register

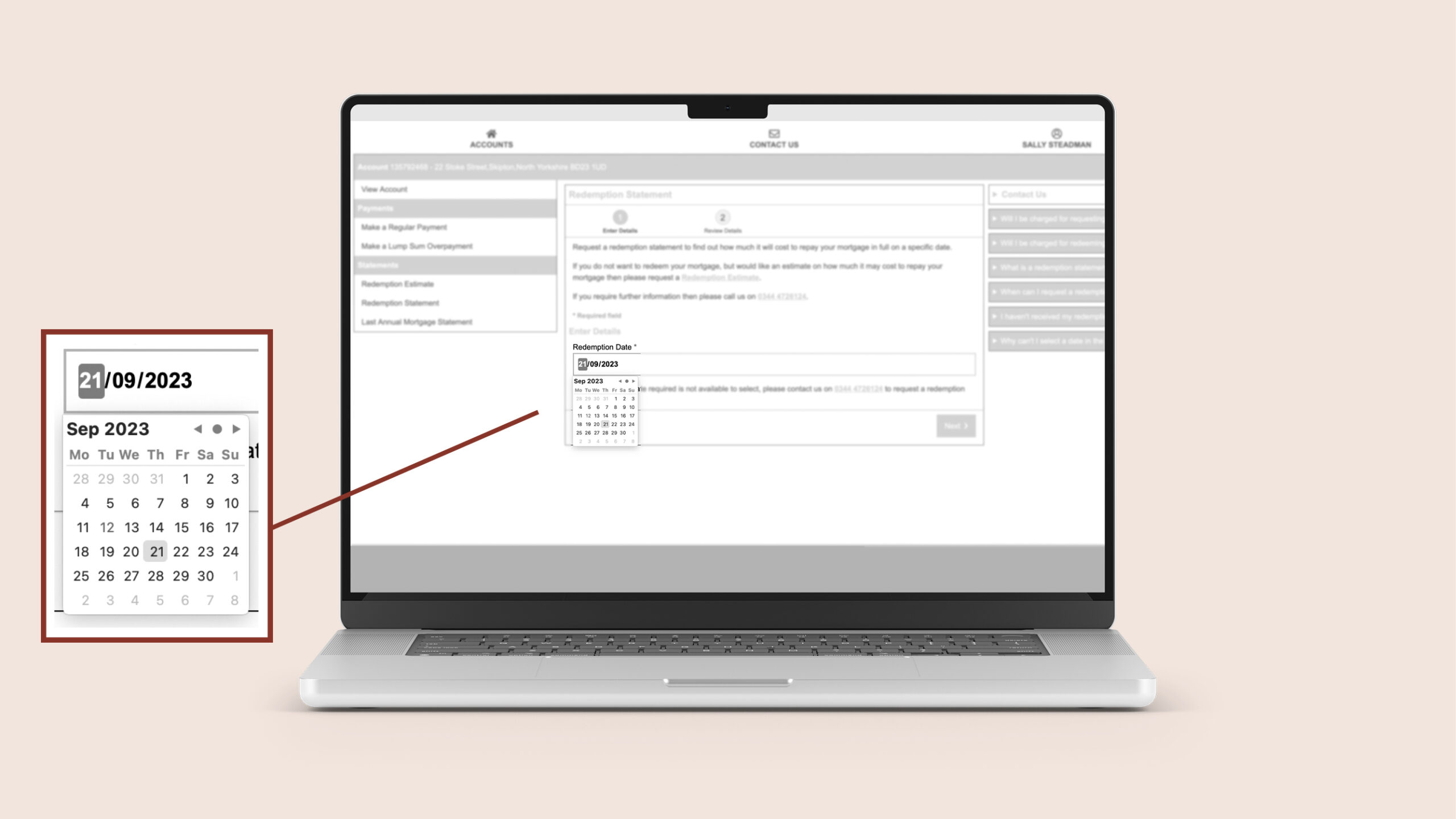

Step 2

Select the date when you intend to redeem your mortgage. You can type this in directly or click on the calendar icon to select the date.

Sign In/Register

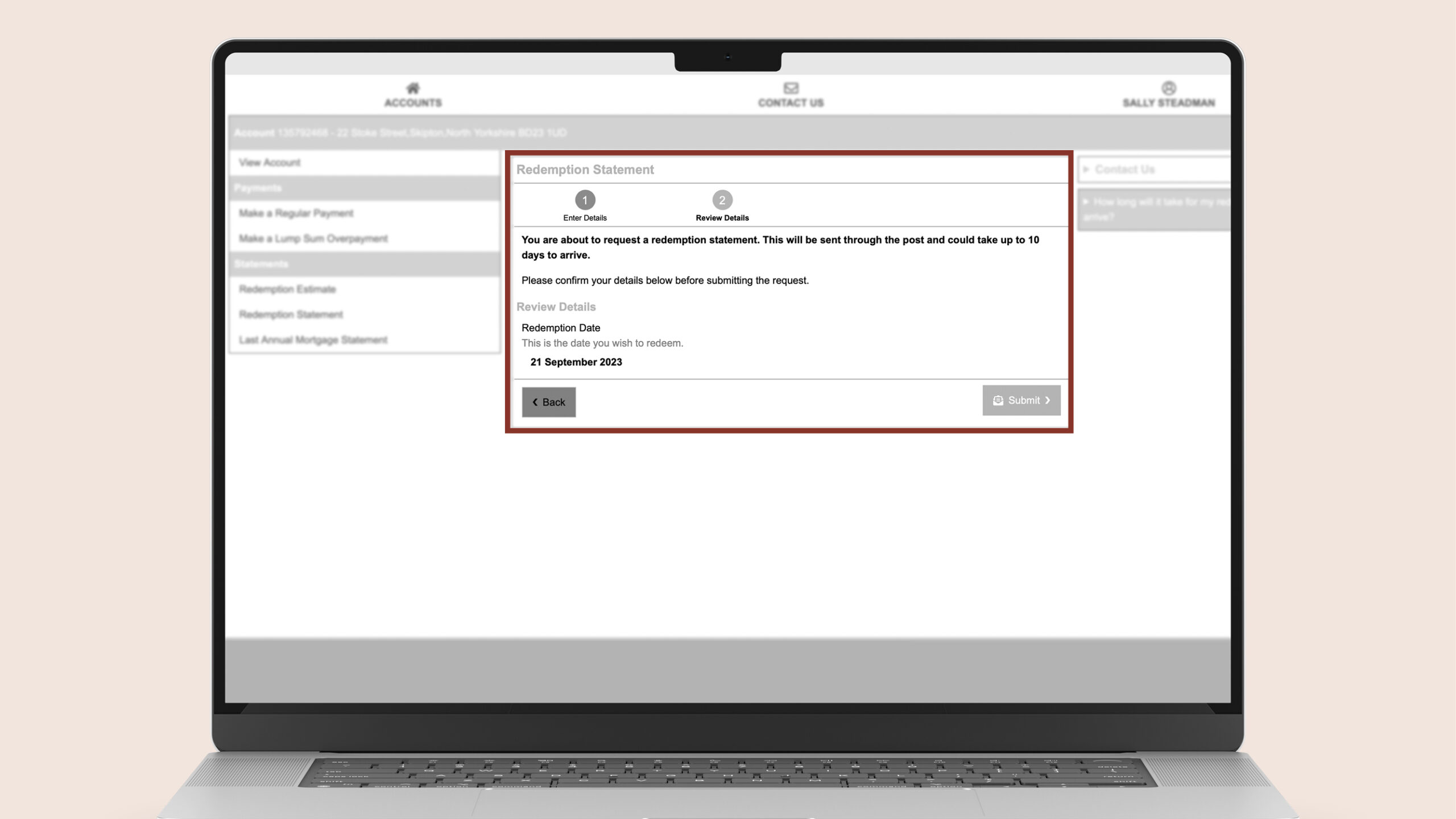

Step 3

Review your request and click Submit. You’ll then see confirmation that we received your request at the top of your Account Summary screen.

Sign In/Register